The industry data presented here is based on leads and inquiries Motion Controls Robotics (MCRI) received throughout 2024. This information offers valuable insights into the automation trends we’re observing across our key industries and closely mirrors broader U.S. market trends.

By analyzing interest from companies seeking end-of-line solutions and robotic automation, we’ve identified which industries are adopting automation the fastest and where the most significant growth opportunities lie. This year’s data highlights both established trends and emerging markets, providing a clear picture of where automation is making the biggest impact.

2024 Industry Request Results

Food and Beverage Industry Leads the Way

In 2024, food and beverage automation continued to dominate as the leading sector for robotics adoption. According to Statista.com, this growth is projected to continue steadily over the next five years. The industry’s investment in robotics is driven by the need to:

- Increase operational efficiency

- Maintain product quality and food safety

- Meet growing consumer demand

- Overcome labor shortages

At MCRI, 30% of our project requests this year came from the food and beverage industry—showcasing food and beverage as the frontrunner for robotic automation adoption.

Building and Construction Industry Gaining Momentum

Robotics and automation in the building and construction industry are rapidly gaining momentum as companies look to streamline operations, reduce labor costs, and meet rising production demands.

Our data reveals that 12% of project requests in 2024 came from the building and construction industry, making it the second-largest industry showing interest in automation. Companies are increasingly exploring end-of-line solutions for material handling, packaging, and palletizing to:

- Keep pace with production demands

- Minimize errors

- Address ongoing labor shortages

As automation grows in this sector, enhancing productivity and maintaining consistent quality remain top priorities for building industry leaders.

💡 Key Insights:

✅ Food and beverage: 30% of our requests

✅ Building & construction: A growing 12%

✅ The medical industry: Poised for major growth in automation

Looking Ahead: The Medical Industry

From what we’ve observed through website visits and inquiries, the medical industry is positioned to be the next sector making a significant push toward end-of-line automation. This shift is likely fueled by:

- Rising production demands for medical products

- Strict regulatory requirements for packaging and traceability

- The need for precise, consistent, and compliant automation solutions

The Bigger Picture: Industry-Wide Trends

Across all manufacturing industries, automation remains a critical focus. According to McKinsey, approximately 25% of capital expenditure over the next five years will be dedicated to exploring and integrating automated systems. The adoption of robotics and AI is expected to drive:

- Improved output quality

- Greater operational efficiency

- Enhanced production uptime

As industries continue to embrace automation, the benefits of streamlined processes and increased reliability are becoming clear.

By highlighting food and beverage as the automation leader, building and construction as a growing segment, and the medical industry as the next frontier, 2024 has shown that automation is more than just a trend—it’s a necessary change a variety of industries are exploring to stay competitive into the future.

Popular Robotic Applications

The chart below shows the applications most requested in 2024. Our most popular applications reflect the growing areas of demand for robotic automation across industries looking to improve efficiency and productivity. From palletizing and case packing to end-of-line solutions, these applications address critical pain points such as labor shortages, production bottlenecks, and quality control. Facilities are streamlining processes, reducing errors, and increasing output, making these solutions essential for staying competitive in today’s fast-paced manufacturing environment.

Palletizing Dominates the Field

33% of our requests are for palletizing, making it the clear leader. Facilities are prioritizing automation in packaging and shipping processes, which are critical for supply chain efficiency. Palletizing is also universally used/needed in almost all industries.

Mapping Robotic Automation Trends

This map highlights the geographic distribution of our project requests throughout the past year, showing a clear concentration in the eastern United States. This high density of requests reflects not only the strong presence of manufacturing, food and beverage, and other industrial operations in the region but also the advantage of MCRI’s central location. While interest spans across the country, including notable activity on the West Coast and parts of Canada and Mexico, the eastern U.S. remains a key hub for companies looking to enhance their efficiency through end-of-line automation and robotics with MCRI. This robotics automation trend underscores the growing demand for automation in established industrial regions.

Have some questions? Here’s an FAQ

Have more? Send me an email.

Why is palletizing the most requested application?

Palletizing is a critical process for industries across the board because everyone stacks their items to ship them. Automating it with robotics increases efficiency, reduces labor costs, and minimizes ergonomic risks for workers. One of the things we say as integrators is start with the low hanging fruit and palletizing is a great application for starting your automation.

What distinguishes roll handling from general material handling?

Roll handling focuses on safely moving, stacking, or loading cylindrical items, which require specialized grippers or equipment, whereas material handling covers broader operations like transporting boxes or goods.

Robots are equipped with specialized end-effectors, software configurations, and vision systems to handle unique product shapes, sizes, and materials.

What is the difference between the BA Palletizer and general palletizing?

The BA Palletizer is a portable, collaborative solution ideal for flexible operations and smaller footprints, while general palletizing solutions cater to high-speed, heavy-duty operations in larger facilities.

What’s included in end of line solutions?

End of line solutions typically combines automating of a variety of processes like: case erecting, case packing, palletizing, labeling, tape inspection, and AGVs/AMRs designed to streamline packaging and shipping operations.

This helps facilities to ensure accuracy, accomplish more consistent throughput rates, and reduce downtime, which is crucial for meeting production demands.

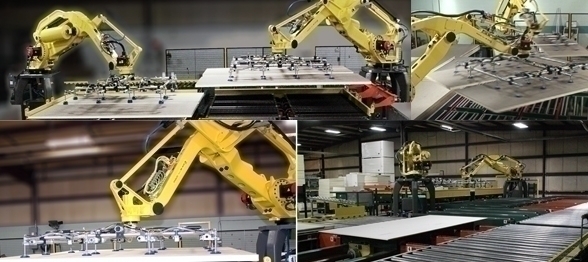

What’s the ROI for investing in these robotic applications?

ROI depends on labor savings, productivity gains, and error reductions. For example, automating palletizing can yield savings within 1-3 years due to reduced labor costs and increased throughput.

How do companies determine which application they need?

Facilities often start with an automation assessment to identify bottlenecks, pain points, and ROI opportunities. Simulation tools can help visualize the benefits of specific applications.

MCRI offers an evaluation to all customer – https://motioncontrolsrobotics.com/contact/automation-evaluation/